Welcome to the law firm ofMark D. Scheinblum, P.A.

Mark D. Scheinblum, P.A. is a boutique business law firm that measures its success by the success of its clients.

The goal at Mark D. Scheinblum, P.A. isn't simply to solve your problems. It's to be a partner with you and your business so you can anticipate, strategize and plan in order to avoid problems and achieve your goals. Mark D. Scheinblum, P.A. is invested in the success of our clients.

Corporate & Business Law

The firm represents a wide-range of corporate and business clients, from the initial formation of corporations, LLCs and joint ventures, and through the life of the business.

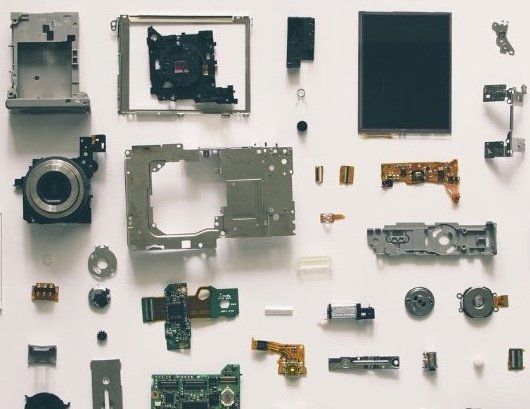

Technology & Licensing

We represent technology companies and start-ups with the commercialization and licensing of innovative new technologies.

News

Mark Scheinblum was selected by his peers for inclusion in the 2020 edition of The Best Lawyers in America

© in the practice areas of Corporate Law and Securities / Capital Markets Law. Mark has been recognized by Best Lawyers

® since 2010.

Mark was also named the Best Lawyers ® 2020 Corporate Law "Lawyer of the Year" in Orlando. Only a single lawyer in each practice area in each community is honored as "Lawyer of the Year".

Since it was first published in 1983, Best Lawyers® has become universally regarded as the definitive guide to legal excellence. Best Lawyers lists are compiled based on an exhaustive peer-review evaluation. Almost 94,000 industry leading lawyers are eligible to vote (from around the world), and we have received over 11 million evaluations on the legal abilities of other lawyers based on their specific practice areas around the world. For the 2020 Edition of The Best Lawyers in America©, 8.3 million votes were analyzed, which resulted in more than 62,000 leading lawyers being included in the new edition. Lawyers are not required or allowed to pay a fee to be listed; therefore inclusion in Best Lawyers is considered a singular honor. Corporate Counsel magazine has called Best Lawyers "the most respected referral list of attorneys in practice."

Mark was also named the Best Lawyers ® 2020 Corporate Law "Lawyer of the Year" in Orlando. Only a single lawyer in each practice area in each community is honored as "Lawyer of the Year".

Since it was first published in 1983, Best Lawyers® has become universally regarded as the definitive guide to legal excellence. Best Lawyers lists are compiled based on an exhaustive peer-review evaluation. Almost 94,000 industry leading lawyers are eligible to vote (from around the world), and we have received over 11 million evaluations on the legal abilities of other lawyers based on their specific practice areas around the world. For the 2020 Edition of The Best Lawyers in America©, 8.3 million votes were analyzed, which resulted in more than 62,000 leading lawyers being included in the new edition. Lawyers are not required or allowed to pay a fee to be listed; therefore inclusion in Best Lawyers is considered a singular honor. Corporate Counsel magazine has called Best Lawyers "the most respected referral list of attorneys in practice."

The State of Florida takes one of the most "business friendly" approaches to non-competition agreements in the U.S., permitting the enforcement of most non-competition provisions “so long as such contracts are reasonable in time, area, and line of business” where the party seeking to enforce the provision can show a legitimate business interest justifying the restriction.

A number of states - most notably California, which bans most post-employment non-competes other than in connection with the sale of a business - have adopted significant limitations on the use of non-competition agreements, and Florida's non-compete law is the topic of frequent criticism as anticompetitive, an unreasonable limitation on employee mobility and potentially causing the loss of a person's livelihood. Notably, Florida courts are specifically instructed under the law to not consider any individualized economic or hardship that might be caused to the person against whom enforcement is sought. This has led other states to view Florida's non-compete statute as against their own public policy when asked to enforce Florida non-compete agreement.

In October, Senators Chris Murphy and Todd Young introduceda bi-partisan bill called the Workplace Mobility Actthat would impose a federal limit on the use of non-compete agreements by employers to only sales of businesses or dissolution of partnerships, giving employees a private right of action, and giving enforcement authority to the Federal Trade Commission and the Department of Labor. While the bill has wide-ranging support, similar bills have failed in recent years.

A number of states - most notably California, which bans most post-employment non-competes other than in connection with the sale of a business - have adopted significant limitations on the use of non-competition agreements, and Florida's non-compete law is the topic of frequent criticism as anticompetitive, an unreasonable limitation on employee mobility and potentially causing the loss of a person's livelihood. Notably, Florida courts are specifically instructed under the law to not consider any individualized economic or hardship that might be caused to the person against whom enforcement is sought. This has led other states to view Florida's non-compete statute as against their own public policy when asked to enforce Florida non-compete agreement.

In October, Senators Chris Murphy and Todd Young introduceda bi-partisan bill called the Workplace Mobility Actthat would impose a federal limit on the use of non-compete agreements by employers to only sales of businesses or dissolution of partnerships, giving employees a private right of action, and giving enforcement authority to the Federal Trade Commission and the Department of Labor. While the bill has wide-ranging support, similar bills have failed in recent years.

Almost five years ago, I posted

about the apparent trend toward the use of representation and warranty insurance in order to facilitate certain mergers and acquisitions in what was then a difficult M&A market.

As Jocelyn Reikie of Deal Law Wire points out, there is finally some data to back up that trend. The American Bar Association’s Private Target Mergers and Acquisitions Deal Points Study for the first time has included an analysis of the use of representations and warranty insurance ("RWI") in its review of publicly available M&A purchase agreements in the limited context of the purchase of private companies by public companies. The results show that 29% of those purchase agreements in 2016 and the first part of 2017 contemplated the use of RWI, usually in the context of buy-side policies which provide insurance to the purchaser. The study also showed that in deals using RWI, the indemnity basket (basically, the deductible applied before any recovery under the indemnity) and the cap (the maximum liability) tended to be lower.

While the limited scope of this study also raises a number of questions - among them, does RWI insurance enable sellers to free up funds from post-sale escrow arrangements? - the widespread availability of RWI insurance should provide an additional tool to help parties reach agreement in otherwise complex transactions.

As Jocelyn Reikie of Deal Law Wire points out, there is finally some data to back up that trend. The American Bar Association’s Private Target Mergers and Acquisitions Deal Points Study for the first time has included an analysis of the use of representations and warranty insurance ("RWI") in its review of publicly available M&A purchase agreements in the limited context of the purchase of private companies by public companies. The results show that 29% of those purchase agreements in 2016 and the first part of 2017 contemplated the use of RWI, usually in the context of buy-side policies which provide insurance to the purchaser. The study also showed that in deals using RWI, the indemnity basket (basically, the deductible applied before any recovery under the indemnity) and the cap (the maximum liability) tended to be lower.

While the limited scope of this study also raises a number of questions - among them, does RWI insurance enable sellers to free up funds from post-sale escrow arrangements? - the widespread availability of RWI insurance should provide an additional tool to help parties reach agreement in otherwise complex transactions.